Posting Groups

Posting Groups define how different types of expenses are posted to the General Ledger in Business Central. They allow bookkeepers and administrators to control the G/L accounts and tax setup used for each expense type, ensuring expenses are posted in accordance with your organization’s accounting requirements.

To support accurate financial reporting, Posting Groups should be created to reflect the appropriate combination of G/L accounts and tax posting groups. When employees submit expenses through the app or web portal, they select an Expense Category, which is linked to a Posting Group and determines how the expense is posted. Please note, that the setup wizard creates a posting group for Mileage.

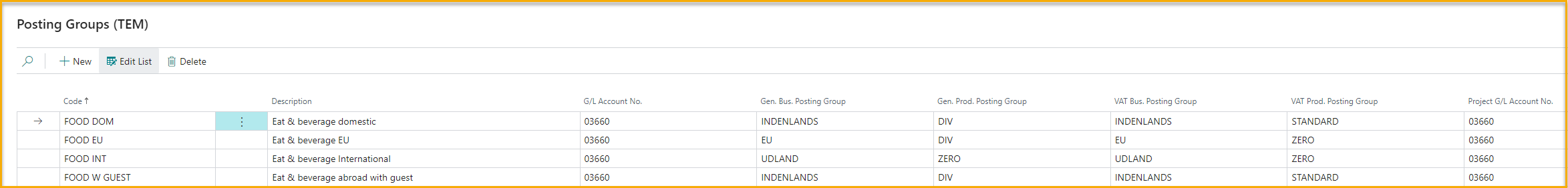

Create/Manage Posting Groups

- From the Travel & Expense Setup – Overview page, select Posting Groups.

- To create a new posting group, select + New

- To manage an existing posting group, select it from the list and make the necessary changes.

- Enter values for the following fields:

- Code: Enter a short, meaningful identifier for the posting group. For example, "FOOD-DOM" for domestic meals, "FOOD-INT" for international meals, or "MISC" for miscellaneous expenses.

- Description: Enter a clear description of the posting group.

- G/L Account No.: Select the G/L account to which this expense type will be posted.

- Tax Related Fields: Populate tax related fields related to your BC localization.

- Gen. Bus. Posting Group

- Gen. Prod. Posting Group

- VAT Bus. Posting Group

- VAT Prod. Posting Group

- Tax Liable

- Tax Group Code

- Project G/L Account No.: Select the Project G/L account to be used when expenses are posted to projects (standard Business Central functionality).