LOCALIZATION & REGIONAL FEATURES

This section highlights how Travel & Expense adapts to different countries and regions. It covers features such as tax handling, VAT or GST rules, meal deduction support, and field visibility based on the company’s location, ensuring compliance and simplifying expense management for global users.

Nordea First Card Integration

In the Nordic countries, Travel & Expense supports real-time transaction integration with Nordea First Card credit cards. When a transaction occurs, users receive a push notification in the app within seconds, allowing them to immediately attach a receipt photo or respond quickly to potential fraud alerts.

How It Works

- A purchase is made using a Nordea First Card credit card.

- The transaction is sent to Travel & Expense in real time.

- The user receives a push notification in the mobile app within seconds.

- The user can attach a photo of the receipt immediately or take action if the transaction appears suspicious.

Visible Field Adjustments

To support regional compliance, Travel & Expense dynamically adjusts which fields are displayed based on the Business Central company location. For companies in North America, tax-related fields are shown, while companies in other regions will see VAT-related fields.

Swedish Meal VAT Deduction Support

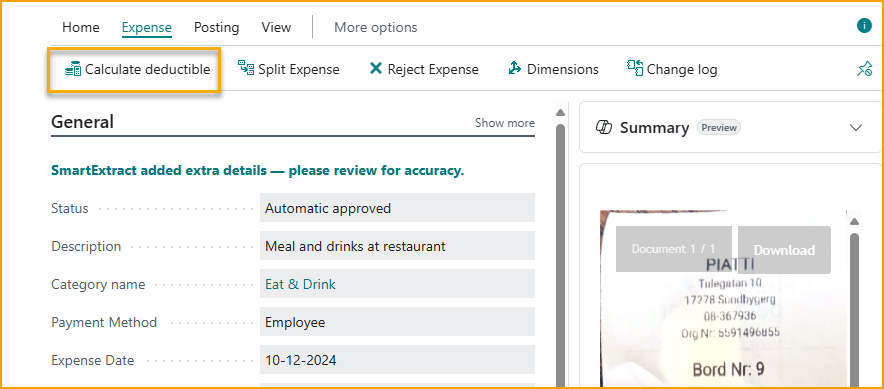

When the Business Central company is registered in Sweden and SmartExtract is configured with posting groups that follow Swedish meal deduction rules—12% VAT for food, 25% VAT for alcohol, and 0% VAT for other items—a dedicated VAT deduction button becomes available in the expense entry.

This feature allows users to automatically calculate eligible VAT deductions in accordance with Skatteverket’s regulations. Once the calculated lines are applied, the expense is adjusted to reflect the correct VAT treatment.

How It Works

- When entering an expense in the app or web portal, SmartExtract analyzes the receipt and identifies items subject to Swedish VAT rules.

- If the company is registered in Sweden and posting groups are correctly configured, the Calculate Deductible (VAT Deduction) button becomes visible.

- Tap the button to automatically calculate the deductible VAT amounts based on the type of expense:

- Food: 12% VAT

- Alcohol: 25% VAT

- Other items: 0% VAT

- The calculated VAT is applied to the expense, reducing manual entry and ensuring compliance with Swedish tax regulations.

Note: The Calculate Deductible (VAT Deduction) button only appears for companies configured in Sweden with SmartExtract posting groups set up according to local rules.

Canadian Tax Handling

When the Business Central company is registered in Canada, SmartExtract automatically applies the appropriate Tax Area to each expense. No additional configuration is required. The system detects whether an expense is taxable and selects the correct Tax Area from the list defined in Business Central.

Note: This automatic assignment ensures compliance with Canadian tax rules and reduces the need for manual entry.

How It Works

- When an expense is entered in the app or web portal, SmartExtract analyzes the receipt and determines if it is subject to tax.

- If the company is registered in Canada, the system automatically selects the correct Tax Area from the list defined in Business Central.

- The assigned Tax Area is applied to the expense, ensuring accurate tax reporting.

- Users do not need to manually adjust tax settings, reducing errors and saving time.

Note: This feature only applies to Canadian-registered companies with properly configured Tax Areas in Business Central.