Per Diem Setup (Pro Edition Only)

Per diems are fixed daily allowances provided to employees to cover travel-related expenses such as meals, lodging, and incidental costs. Instead of reimbursing each individual expense, a per diem provides a set amount for each day of travel.

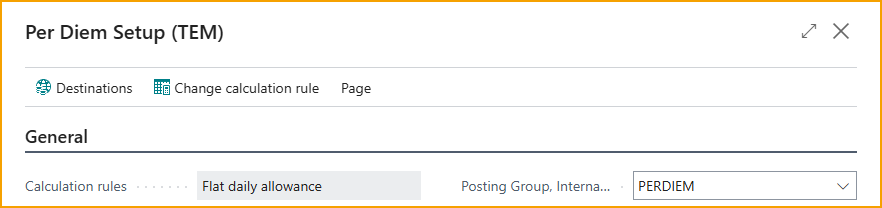

The Per Diem Setup page allows you to configure the basic settings for the per diem functionality. This includes defining default rates, meal deductions, and the calculation rules that determine how per diems are calculated.

-

From the Travel & Expense Setup – Overview page, under the Per Diem section, select Setup

-

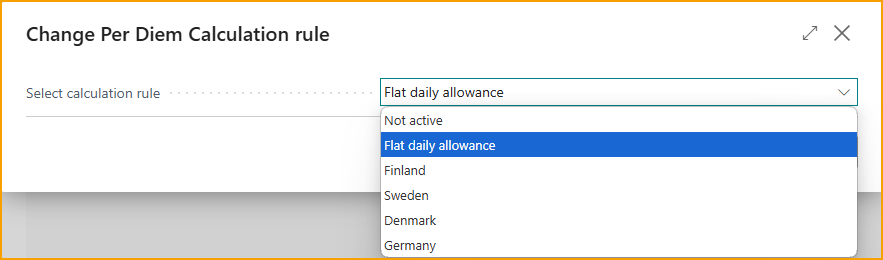

Change Calculation Rule: To change the calculation rule, select Change Calculation Rule on the action bar, this will activate per diem functionality and select the calculation rule to be used.

- Select Calculation Rule: Select the appropriate calculation rule. Rules for calculating per diems vary by country. Currently, TEM supports the following calculation rule sets: Sweden, Finland, Denmark, Germany, and a general “Flat Daily Rate” rule.

- Flat Daily Allowance

- Finland

- Sweden

- Denmark

- Germany

Depending on the selected rule, different configuration options will be available to tailor the per diem settings for that country or rule type.

- Posting Goup, Domestic: Select a Posting Group to use for domestic expenses.

- Posting Group, International: Select a Postin Group to use for international expenses.

- Select Calculation Rule: Select the appropriate calculation rule. Rules for calculating per diems vary by country. Currently, TEM supports the following calculation rule sets: Sweden, Finland, Denmark, Germany, and a general “Flat Daily Rate” rule.

-

Number Series

- Per Diem: Select the number series you wish to use for per diem expenses.

- Posted Per Diem: Select the number series you wish to use for posted per diem expenses.

-

Deductions: (Flat Rate Allowance Only)

-

The Deductions % section in Per Diem Setup allows you to specify the percentage of the daily per diem to deduct when meals are provided by the employer, included in a hotel stay, or otherwise covered. This ensures that employees are only reimbursed for meals they need to pay for, avoiding overpayment

- Breakfast: The percentage of the daily per diem to deduct if breakfast is provided.

- Lunch: The percentage of the daily per diem to deduct if lunch is provided.

- Dinner: The percentage of the daily per diem to deduct if dinner is provided.

For example: If an employee’s per diem is $100 per day and breakfast is provided, and the Breakfast deduction is set to 20%, then $20 will be subtracted from the daily per diem, and the employee will receive $80 for that day.

- Rates - Specify the rates to be used for the provided options. Different options display based on the Calculation Rule selected.

Destination Rates

Based on the Calculation Rule selected, you can set up Destination Rates which allow you to set up specific per diem rates for different travel destinations. This is useful when rates vary depending on the location an employee travels to.

Create a new Destination Rate

- From the Travel & Expense Setup – Overview page, under the Per Diem section, select Destination Rates

- Select +New to create a new destination rate.

- Destinations: From the Per Diem Setup action bar, select Destinations.

- Country Code: Enter in the 2-letter country code for the destination.

- Name: Enter a description name of the destination.

- City: Optionally enter a city if rates differ by city within the selected country..

- Rate: Enter the per diem rate that applies for the destination for the Per Diem Period that has been set up.

Periods

The Per Diem Periods Setup is used to define the time periods that determine which per diem rates are applied to expenses. Periods allow you to manage per diem rates over time, making it easy to track historical rates and introduce new rates for future periods, such as a new fiscal or calendar year.

Each period represents a defined date range (for example, a calendar year) and is linked to a specific set of per diem rates. When an expense is created, ExFlow Travel & Expense automatically applies the correct per diem rate based on the expense date and the active period.

Administrators typically create a new period when per diem rates change, such as at the start of a new year. Existing periods should remain unchanged to ensure accurate reporting and auditing of historical expenses.

Create a new Destination Rate

- From the Travel & Expense Setup – Overview page, under the Per Diem section, select Periods

- Select +New to create a new per diem Period.

- Code: Enter a short, meaningful identifier for the period.

- Description: Enter a clear description for the period.

- Starting From: Enter the date from which the per diem rates defined for this period will apply. Expenses dated on or after this date will use the rates associated with this period.